Battery electric vehicles (EVs) now account for 18% of global sales, with European sales expected to accelerate as emissions restrictions tighten. With the support of the TSE Energy & Climate Center, a team of researchers is investigating the complex interplay of EV adoption, charging behavior and electricity costs. Focused on Germany, their findings suggest that price incentives can offer a triple dividend for the energy transition.

Why is consumer charging behavior so crucial to the success of EV policies?

Rapid electrification of the automobile sector risks driving up electricity prices, which could reduce consumer demand for EVs by increasing their operating costs. In Germany, the EV stock reached 1.4 million in 2023 and the government aims to have 15 million EVs on the road by 2030.

Unlike global oil markets, electricity markets are characterized by local systems and hourly generation costs tend to fluctuate considerably. Over a 24-hour period, the wholesale price of electricity varies by an average of 66% in Germany – from around €75/MWh to €125/MWh – while retail and charging station prices remain fixed.

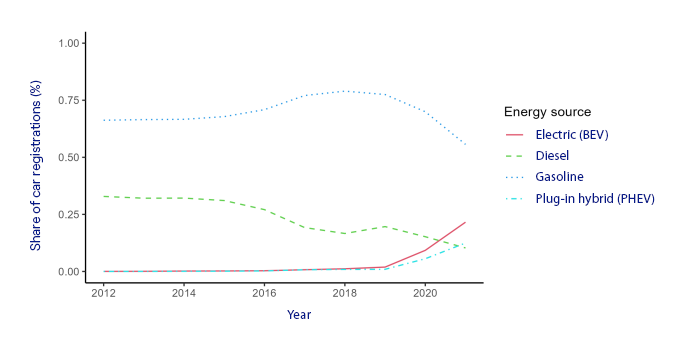

Electric car sales in Germany

By 2021, the combined market share of BEVs (battery electric vehicles) and PHEVS (plug-in hybrids, with both a chargeable battery and a combustion engine) reached almost 40%. The research featured here focuses on BEVs.

To predict the energy and environmental costs of EVs, we must therefore pay close attention to consumers’ charging patterns. EVs have been shown to be more polluting than combustion vehicles when charged during hours when coal is the marginal energy source. This is a significant problem in countries where the marginal energy supply shifts between renewable and fossil-fuel sources during the day. In response, energy suppliers in the US and elsewhere are experimenting with time-varying rates to incentivize EV owners to avoid peak-hour charging.

How does your research explore the impact of EV adoption?

We develop a joint equilibrium model of the German electricity and automobile markets, emphasizing the timing of EV charging. We do this by modeling EV owners’ optimal charging decisions, vehicle choices, and wholesale electricity prices. The model allows us to study the impact of EVs on electricity markets, as well as the full feedback loop between EV demand and electricity prices.

We obtain intraday electricity load profiles from EVs and compute expected electricity costs from home and public charging for different vehicles. We rely on the responses of over 60,000 respondents to the “Mobilität in Deutschland 2017” survey to construct individual driving profiles. For each of these profiles, every EV model available on the German market, and each region, we calculate more than 11 million optimal charging patterns.

We use car registration data to model consumer choices, accounting for vehicle prices and the indirect network effect between charging stations and vehicle demand. As well as observing market shares, we observe electricity consumption at charging stations throughout the day. This is crucial to identify which consumers charge at home and the different levels of disutility for refueling, home charging, and public charging. We also allow the convenience of EV charging to be improved by the availability of charging stations.

We study two scenarios. In the first, EV consumers are shielded from wholesale price fluctuations so there is no incentive to charge off-peak. In the second, electricity rates vary throughout the day and every household charges optimally, as if using a device that makes cost-minimizing decisions. In both scenarios, we compare a no-EV equilibrium with one in which EVs represent 10% of the vehicle stock.

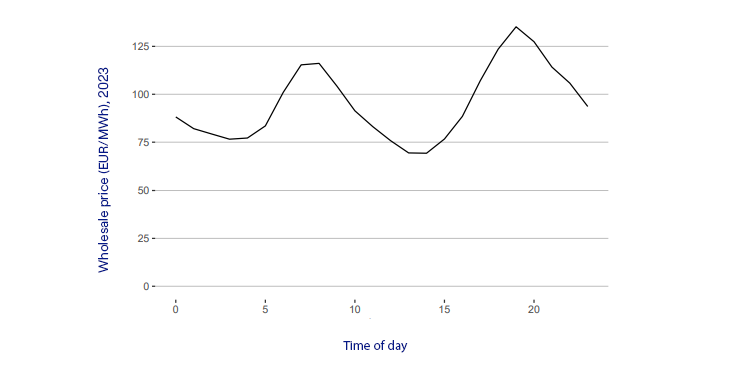

Hourly electricity prices

This graph shows Germany's average intra-day wholesale electricity price curve in 2023. High demand and lower renewable generation (especially solar) create price peaks in the morning and evening.

What are your key findings?

When electricity prices are constant across the day – as is currently the case in Germany and many other countries – we reveal three main insights:

• A 10% EV stock increases wholesale prices by €1.60 and imposes a substantial cost on all electricity users of around €0.66 for every €1 spent on charging.

• This increase in electricity prices – by about 1% – has little effect on EV adoption. Until the EV stock rises far above 10%, electricity prices will not increase enough to make EV buyers switch back to combustion engines.

• Using large amounts of fossil-fuel generated electricity, EV carbon emissions (about 91 gCO2/km) are not much better than the current EU standard for combustion engines (95 gCO2/km).

• A 10% increase in renewable generation makes only a small dent in EV emissions (about 3 gCO2/km) and barely changes the cost imposed on electricity users. If pre-existing electricity demand expands by 10%, the cost imposed increases to €0.87 and EVs become more polluting.

In contrast, exposing EV chargers to time-varying prices generates a triple dividend:

• The financial penalty of EV charging on electricity users almost disappears and shrinks to less than 10 cents per €1 charged. EV owners shift charging to off-peak hours, removing the pressure on peak-hour prices.

• EVs become much greener because emissions from charging are reduced by 30%.

• EV adoption expands by 3%, thanks to the substantial drop in operating costs. If EV chargers can access low-priced electricity charging, they can charge at rates that are substantially lower than the fixed rates.

Overall, our results highlight the substantial benefits – for electricity users, EV owners, and the environment – from improving the flexibility of EV charging and exposing it to wholesale electricity costs. Combined with smart meters, time-varying prices encourage EV chargers to avoid costly, carbon-intensive peak hours. Their introduction makes EVs much greener than boosting renewable energy generation. EV-induced electricity rate increases will not hold back adoption, but the EV transition will accelerate if EV owners can benefit from off-peak wholesale electricity prices.

FURTHER READING ‘Equilibrium Effects in Complementary Markets: Electric Vehicle Adoption and Electricity Pricing’ and other publications by these researchers are available to read on the TSE website.

Article published in TSE Reflect, January 2025